Why You Need to Insure Your Commercial Truck to Its Current Value

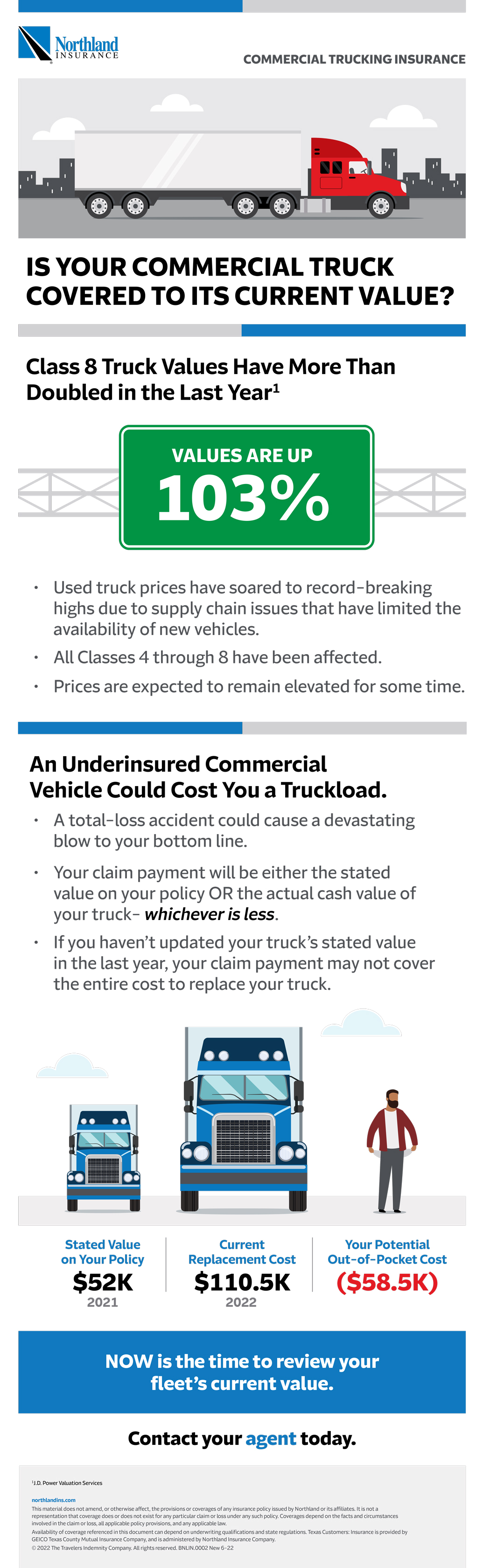

Owner-operators in the commercial trucking business need to know that their vehicle will be valued in two ways by their insurer should it be involved in an accident. The first is the stated value listed in their policy. The second is the actual cash value of the vehicle. The insurance carrier will pay the lesser of these two amounts.

What happens if the stated value in the policy is no longer accurate given the rise in commercial truck prices over the last year? Your truck would be underinsured, meaning your insurance payment would not be enough to cover a comparable vehicle should you experience a total loss. Delays in replacing your truck cost your business, and some smaller trucking firms might be irreparably damaged.

In the infographic below, we’ll share critical insights on these trends and what you need to do to make sure your commercial trucks are insured to their current value.